Create a secure future and grow personal wealth.

Our experienced financial team will show you a simple path to growing your net worth.

Our experienced financial team will show you a simple path to growing your net worth.

When partnering with our team, we provide our clients with an uncomplicated personalized plan to help build their financial portfolios and the future they desire.

You deserve an advisor who is tuned into you and your goals.

Get your money invested and working for your future, simply and steadily.

Reach your retirement with comfort and financial confidence. Get a simple plan from an experienced and empathetic guide.

History has told us a tried-and-true approach to investing works – a conservative quality dividend portfolio that performs well over the long term.

Follow an understandable strategy from a knowledgeable advisor dedicated to serving you.

How to work with us in 3 simple steps

We’ve made planning for your future clear, personal, and easy to begin.

Get a high level scan

of your life and money snapshot at present with your timing of future events.

Establish your risk tolerance threshold

and learn about the strategies your advisor can use to help you.

Agree on a road map

that you and your advisor will design to create your financial future. Journey ahead supported at every step towards growing your wealth.

Contact Us

Send us your questions or schedule a free consultation

Contact Us

No matter what stage of life you’re in, it’s a good time to start planning for the future. Send us your questions or request an appointment so we can discuss your financial goals together.

National Bank Financial Wealth Management

Whitehouse Retirement Wealth Group

Address:

239 8th Ave. SW, Suite 200

Calgary, Alberta

T2P 1B9

Phone:

James Whitehouse: james.whitehouse@nbc.ca

Fernando Ponce: fernando.ponce@nbc.ca

Katlyn Irvine:

katlyn.irvine@nbc.ca

Kristianne Ancis: kristianne.ancis@nbc.ca

Connie Hykaway: connie.hykaway@nbc.ca

Our Services

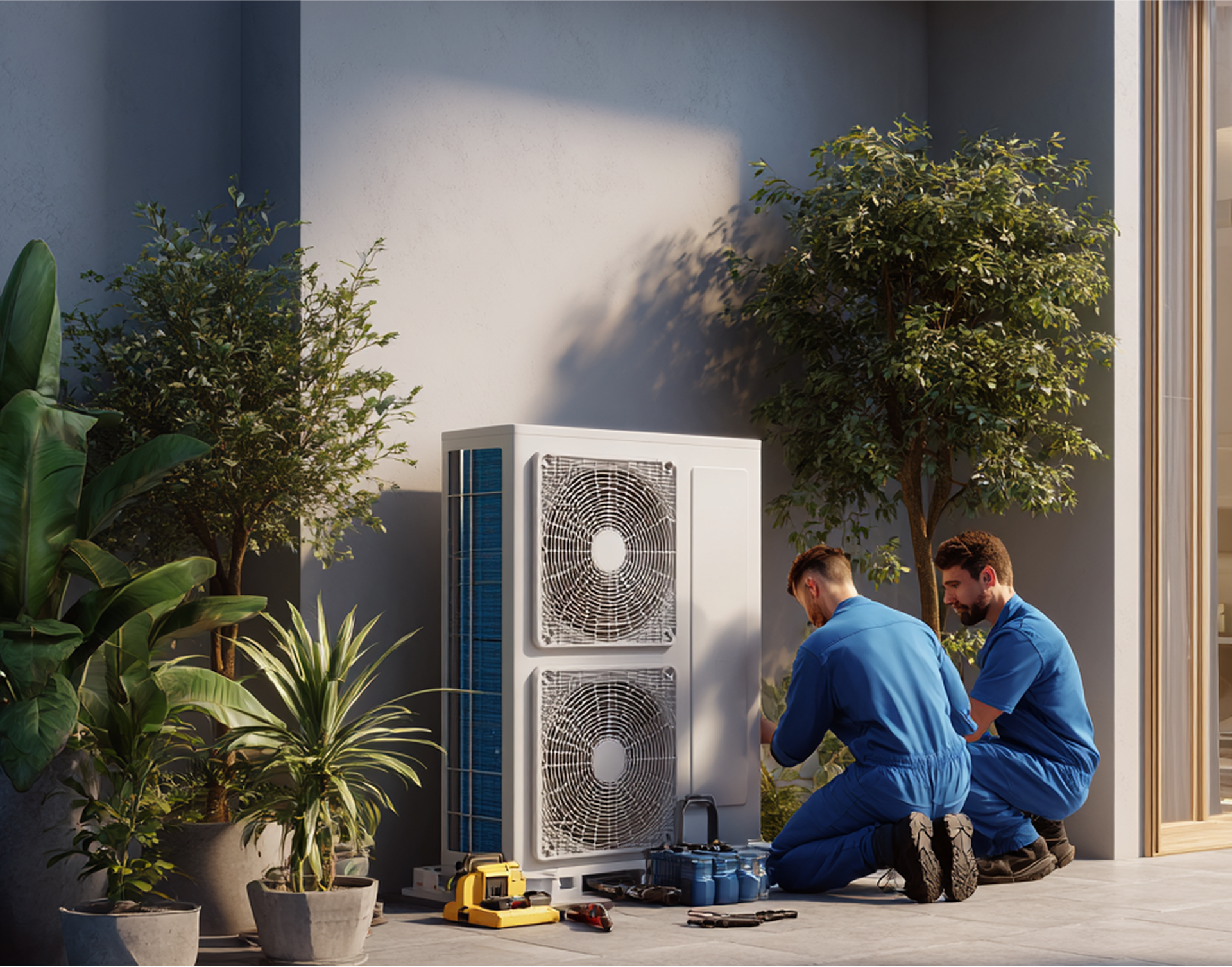

AC Installation & Replacement

4.8* average rating from recurring clients

From furnaces to heat pumps, we ensure your space stays warm and efficient all winter long.

We do it all, with a smile :)

Heating installation & replacement

4.8* average rating from recurring clients

From furnaces to heat pumps, we ensure your space stays warm and efficient all winter long.

We do it all, with a smile :)

HVAC Repairs

4.8* average rating from recurring clients

From furnaces to heat pumps, we ensure your space stays warm and efficient all winter long.

HVAC repairs

Thermostats & Smart Controls

4.8* average rating from recurring clients

From furnaces to heat pumps, we ensure your space stays warm and efficient all winter long.

Thermostats & Smart Controls

What Our Customers Are Saying

Don’t take it from us. All of these testimonials are 100% honest and unsolicited.

“They treated our home like their own.”

From the first call to the final inspection, everything felt seamless. The Airthorne team worked efficiently and respected our space. Truly professional service.

— Lena D., Montclair

“Quick, clean, and professional.”

Airthorne replaced our old AC system in just one day. The crew arrived on time, explained everything clearly, and left no mess behind. We noticed the difference immediately — the house has never felt this comfortable!

— Jessica R., Westfield

“Honest service you can trust.”

We had no heat during a cold snap, and Airthorne came through fast. They didn’t upsell or overcharge — just fixed the issue and made sure everything was working perfectly. Can’t recommend them enough.

— Tom M., Essex County

“Showed up fast and got it done right.”

We had a last-minute issue before a big family gathering — no heat! Airthorne responded quickly, diagnosed the problem, and had us up and running in no time.

— Marissa G., Maplewood